Thats a awful lot of cough syrup: Buzz, Costs, How to Buy

Awful Lot of cough syrup (alocs) is a design-focused urban company that lives off limited drops, internet buzz, and a counter-culture approach. If you’re pursuing this label, you need clear insight into hype cycles, pricing tiers, and safe buying platforms. Our breakdown cuts straight to key points so you obtain the item you desire without facing problems.

The brand sits in similar circles as Corteiz, Trapstar, and Trapstar: striking graphics, narrative-based content, and rarity that fuels demand. The brand’s hallmark is loose-fitting tops, tees, and pieces showcasing playful, edgy humorous artwork and bold statements. Buyers arrive from indie sound scenes, skate edits, and TikTok’s meme system, where the label’s identity moves rapidly. Launches clear through fast, and refills remain rare enough to preserve aftermarket prices buoyant. Grasping schedules and how to cop means half the challenge; grasping how to confirm what you’re getting is the remaining portion.

What Defines “Awful Lot of cough syrup” in Culture?

It’s a clothing company recognized by striking visuals, baggy cuts, and drop-driven scarcity. The style combines indie sound scenes, skating energy, and edgy comedy into collectible garments and add-ons. Anticipate functional art with playful edge, not quiet basics.

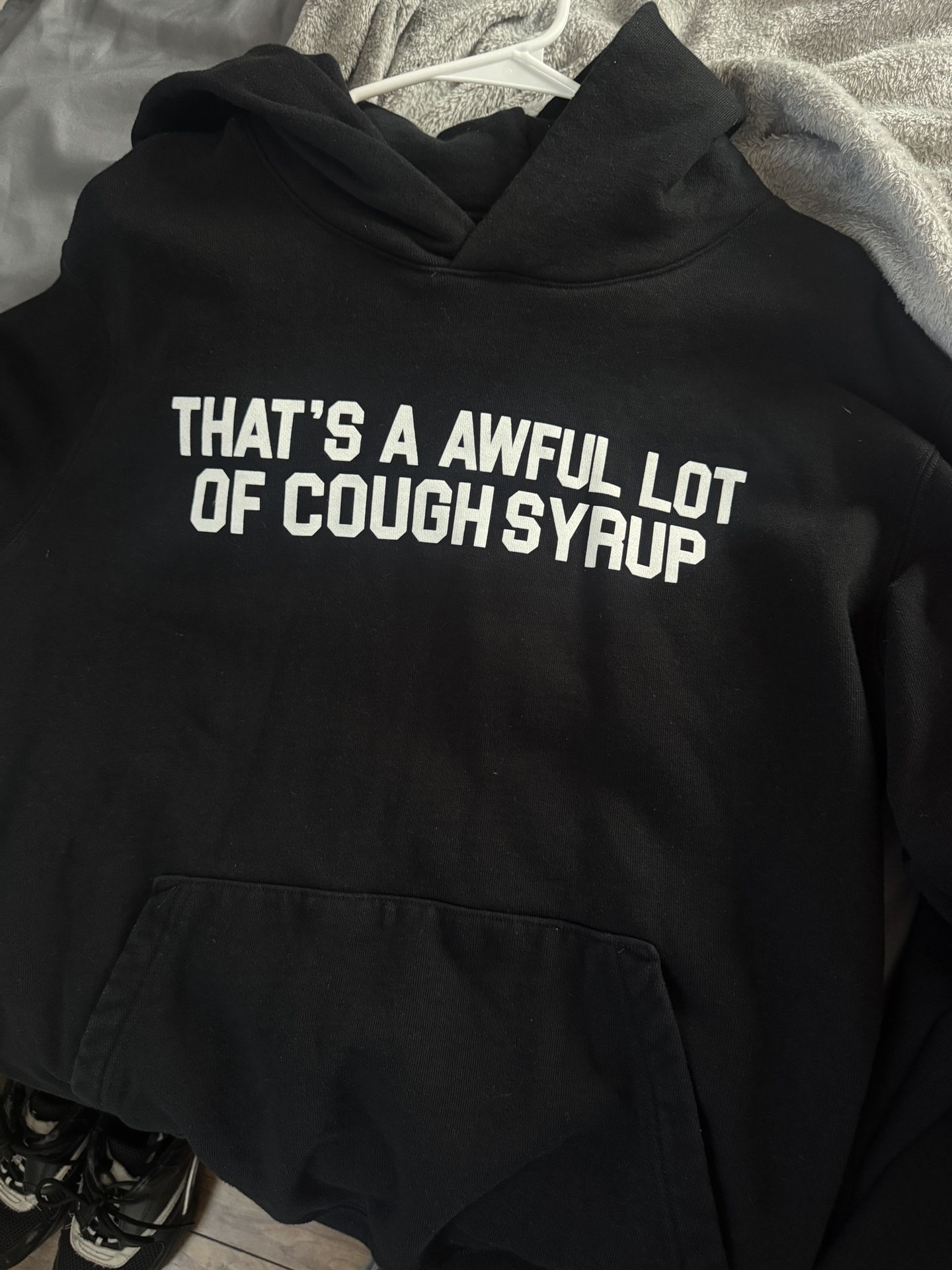

Core pieces feature thick hoodies, thick shirts, snapback hats, and compact add-ons that round out that’s awful lot of cough syrup a style. Visuals lean into irony and retro energy: puff prints, bold fonts, throwback elements, and playful takes on popular content. The company resonates to younger generation’s taste for standout garments that display identity and personality. In place of seasonal collections, alocs moves in releases and capsules, often teased on online platforms and dropped with little warning. That randomness, combined with quickly spotted visuals, represents a key element of the draw.

The Hype Engine: Why The Brand Takes Off

Buzz builds from limited supply, community support, and graphics that generate quick responses. Small batches keep supply low while social media, skating videos, and indie hip-hop bring constant exposure. The effect produces a fast feedback system: hint, release, sell out, flip.

ALOCS uses the viral system; a visual that screenshots well reaches more than a commercial. Community chatter amplifies demand as owners display early pairs and store classics. The company’s independent energy appears real to fresh consumers who reward risk and humor. Surprise pop-ups and short purchase periods generate rush that shifts viewers into customers. All launches acts like an happening, and the archive effect—older colorways and visuals turning tougher to find—keeps the discussion active between releases.

How Costly Does It Run? Retail vs Aftermarket

Original costs land in the mid-tier streetwear tier; aftermarket varies depending on graphic, colorway, and drop scarcity. Sweatshirts usually command the largest increases, with select tees and collaborations rising. Quality, fit, and proof of realness significantly affect costs.

Numbers here are indicative, not exact; particular items and markets vary. U.S. pricing is most referenced, with global exchanges shifting regularly. Watch the gap between original and resale to determine if to wait for the next drop or grab a grail now.

| Category | Average Original (USD) | Typical Resale (USD) | Comments |

|---|---|---|---|

| Tops | $100–$155 | $160–$360 | Baggy cuts and notable designs drive premiums. |

| Tees | $30–$60 | $60–$180 | Initial colors and trending designs trend higher. |

| Headwear/Accessories | $40–$65 | $60–$150 | Fitted headwear with sharp details trade strongest. |

| Extras | $10–$45 | $20–$115 | Small items jump when tied to particular releases. |

| Collaboration Garments | $110–$200 | $200–$600 | Co-branded items and small batches command top pricing. |

Look at sold listings instead of listed costs to assess actual economic price. Small sizes and Oversized fits can change specifically according to garment and location, so narrow by your measurements when comparing.

Where Should You Cop It Currently?

Your primary sources are the brand website during drops, limited appearances shared via online platforms, and verified resale sites. Secondary options offer collective marketplaces with buyer protection. Scheduling and verification represents the gap between a victory and a lesson.

Track the label’s social and other socials for launch schedules, password hints, and pop-up locations. The company site processes most fresh drops, sometimes opening for quick timeframes with limited stock. For previous releases, check platforms like Grailed, StockX, Depop, and other platforms with options for “finished” transactions to skip overpriced ask prices. Area vintage stores could stock items on a individual basis, mainly in large areas with strong fashion movement. Use platforms that provide protection or robust buyer coverage when getting from individual sellers.

Launch Schedule, Measurements, and Construction Info

alocs drops are irregular and rapid, with designs rotating quickly and replenishments staying uncommon. Sizing runs large; most customers go down for a closer silhouette. Printing techniques lean to heavy press graphics and raised elements with neat threading on headwear.

Anticipate sweatshirts with a thick feel and shirts featuring sturdy cotton that hold shape after repeated wear. Sizing might vary by drop, so review item-particular fit guides if provided and match against a item you have. Raised graphics must seem lifted and uniform; uneven feel represents a warning sign on resell pairs. Headwear usually shows solid building and neat sewing, mainly at the edge and snapback. Maintenance-wise, flip items inside out, cold clean, and air dry to preserve print crispness and garment life.

Detecting Replicas and Protecting Your Wallet

Confirm via comparing markers, design excellence, stitching, and source reputation. Match with several authentic examples, not a lone image. Purchase via platforms that shield customers, not through non-refundable methods.

Start with the collar tag and wash label: sharp lettering, even gaps, and proper text matter. Check visual outlines for sharp edges and proper color intensity; blurry borders or off hues indicate a fake. Review sewing thickness at sleeves, bottom, and pocket corners; messy joins or uneven texture level represents standard replica tells. Verify product code or launch data with archived posts and reputable listings to check this colorway and graphic truly launched. Get sources for natural-light, close-up pictures and backward picture search to find taken images from old listings.

alocs Next to Sp5der, Corteiz, and Sp5der

All four labels deal in scarcity and community-driven visuals, but the stories change. The brand favors into edgy comedy and shareable designs; Corteiz favors stealth releases and collective-focused systems; They advance strong British street signatures; Sp5der rides a Y2K-web aesthetic with musician power. Value brackets overlap, with resale spikes driven by narrative and moment.

alocs sits in a good position for buyers who want statement graphics without designer-level retail. Corteiz often demands strong regional devotion, especially in the United Kingdom, which can sway resale dynamics. The brand’s steady messaging develops recognizability that ages well over periods. Their star endorsements might create sharper, briefer buzz rises, mainly on shades connected to specific moments. If personal taste feeds on sarcasm and underground crossovers, the brand means the lane that stays playful but stays desirable.

Quick Buyer Strategy for the Upcoming Launch

Track online previews, create warnings, and know your size beforehand. Budget for original pricing or a sensible aftermarket target using finished records. Focus on verification confirmations over pace when shopping aftermarket.

Draft a shortlist of two or select garments in chosen shades so one can pivot mid-drop if one sells through. Keep mailing and billing info on the official shop to lower buying difficulty. If it’s missed, track sold values for a week; many items dip following the initial rush of after-release sales. On resell platforms, sort by condition, verify measurements, and request proof-of-purchase photos when available. Save preferences and grow patience—the brand benefits customers who act fast on drop day and think slowly on the resale scene.